Scope Markets Minimum Deposit

Minimum Deposit Requirements

Scope Markets establishes accessible entry points for trading accounts through structured minimum deposit requirements. The standard minimum deposit starts at $50 USD or equivalent in other currencies. This requirement applies across different account types while maintaining consistent trading conditions. Account funding supports multiple payment methods with varying processing times.

Account Type Deposits:

| Account Type | Minimum Deposit | Currency Options |

| One Account | $50 | USD, EUR, GBP |

| Islamic Account | $50 | USD, EUR, GBP |

| Scope Elite | $20,000 | USD, EUR, GBP |

| Scope Invest | $50 | USD, EUR, GBP |

Payment Methods

The platform supports various payment options for account funding. Each method maintains specific processing times and security protocols. Electronic payment systems provide immediate account crediting in most cases. Traditional banking methods may require additional processing time. All transactions undergo security verification before completion.

Available Payment Options

Current deposit methods include standard financial channels:

- Credit/Debit Cards

- Bank Wire Transfer

- Electronic Payment Systems

- Local Bank Transfers

- Mobile Payment Solutions

- Digital Wallets

These options ensure convenient account funding while maintaining transaction security.

Currency Requirements

Account deposits accept multiple currency options to accommodate different regions. Currency conversion applies when deposit currency differs from account base currency. Exchange rates follow current market conditions during conversion. Transaction fees may apply for certain currency conversions. Multiple currency accounts require separate minimum deposits.

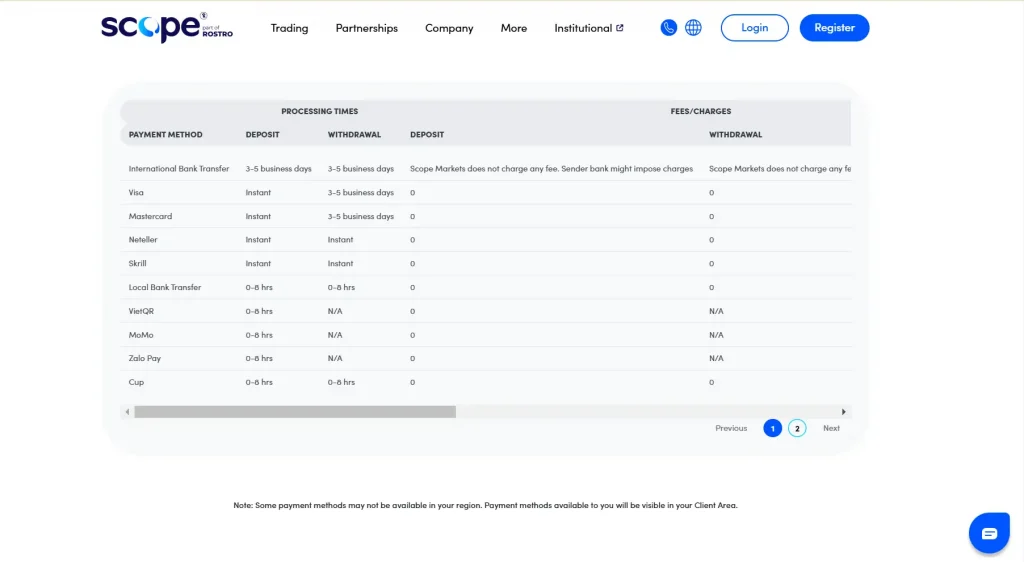

Processing Times

Deposit processing varies based on selected payment methods and verification requirements. Electronic payments typically complete within minutes of confirmation. Bank transfers may require 1-5 business days for processing. Verification procedures may extend processing times for security purposes. Status updates provide transaction progress information.

Verification Requirements

Initial deposits require completion of account verification procedures. Documentation requirements follow regulatory standards for identity confirmation. Verification status affects deposit limits and processing times. Additional verification may apply for large deposits or specific payment methods.

Required Documentation

Standard verification requires specific documents:

- Government-issued identification

- Proof of residence

- Payment method verification

- Source of funds declaration

- Tax identification

- Employment information

These requirements ensure compliance with regulatory standards while maintaining security.

Transaction Security

Security measures protect all deposit transactions through multiple verification layers. Encryption protocols secure data transmission during processing. Payment providers implement additional security measures for transaction protection. Account monitoring systems detect unusual deposit patterns. Security alerts notify users of transaction status changes.

Deposit Limits

Account types maintain specific deposit limits based on verification level and status. Initial deposits must meet minimum requirements for account activation. Maximum deposit limits vary by payment method and account type. Regular review adjusts limits according to account activity and status. Support teams assist with limit adjustments when required.

Additional Charges

Certain payment methods may incur processing fees from payment providers. Fee structures vary based on payment method and transaction amount. Currency conversion may include standard exchange rate margins. Account funding remains free through most electronic payment methods. Traditional banking services may apply standard transfer fees.

Fee Structure

Transaction fees depend on several factors:

- Payment method selected

- Transaction amount

- Currency conversion requirements

- Processing time requirements

- Geographic location

- Bank intermediary charges

Understanding these components helps optimize deposit costs.

Account Funding Process

The deposit process follows structured steps for security and efficiency. Account holders select payment methods through the client portal. Transaction details require confirmation before processing begins. System verification ensures accurate payment routing and processing. Confirmation notifications provide transaction completion status.

Failed Transactions

Transaction failures receive immediate system attention for resolution. Common issues include incorrect payment details or verification requirements. Support teams assist with transaction resolution and reprocessing. Alternative payment methods may be recommended for failed transactions. Records maintain documentation of resolution procedures.

Deposit Management

Account holders maintain control over deposit management through the client portal. Transaction history provides detailed records of all deposits. Regular statements summarize account funding activities. Support services assist with deposit-related inquiries and issues. Management tools enable effective deposit tracking and planning.

FAQ:

Electronic payments typically reflect immediately, while bank transfers may take 1-5 business days.

Yes, deposits in local currency convert to account base currency at current exchange rates.

Deposits below minimum requirements return to the source account after failed verification.